📌 Christmas Marketing Trends 2025

Customers start planning for Christmas in June. Your strategy should, too.

🌞 Welcome to this Week's Newsletter

In case you were wondering about why I’m bringing up Christmas now… according to Statista, search intent for holiday bookings starts as early as June, with gifting searches peaking in October. Guests are booking early, not from excitement, but from pressure. And yet most hospitality brands still plan for a December launch.

Here are the trends, the data, and the strategies you need to get ahead of the competition this Christmas season.

Let’s Check In ☕

🎄 Christmas Marketing Trends for 2025

💸 Spending Trends to Watch This Christmas

Holiday budgets are up, with an 8% increase in spending according to Deloitte’s 2024 Global Holiday Survey. However, 42% of shoppers buy for fewer people, focusing on meaningful gifts for a close circle. This shift reflects a growing trend of consumers choosing quality over quantity, seeking thoughtful gifts that reflect personal connections rather than simply fulfilling obligations.

Dining is at the centre of this shift. Mastercard’s 2024 SpendingPulse reports significant growth in restaurant spending year-on-year, especially in group dining and premium casual. For hotels, the demand for experiences also extends to dining, with online sales up by 6.7%, driven by digital gift cards, event menus, and convenience add-ons.

Whether you're a restaurant or hotel, guests search for dining experiences that feel like special gifts to share. Offers should be distinct, visually striking, and framed as exclusive celebration events or thoughtful gifts. Anything that feels routine or unremarkable risks being overlooked.

As economic pressures rise, Millennials are prioritising meaningful, affordable gifts. With 66% seeking better prices and promotions, deals don’t have to mean discounts. Instead, create value-based bundles that offer more without lowering prices.

As Brian McCarthy, Principal at Deloitte Consulting, notes, consumers seek value.

"They are finding ways to make their dollars go further on the gifts they want to give and the events they want to experience."

🎅 Understanding Buyer Behaviour This Holiday Season

For Gen Z and Millennials, Christmas doesn’t start with excitement; it begins with tension. They’re buying early to manage anxiety, not to feel festive. These generations are susceptible to pressure and stress during the festive period.

Christmas shopping has become a balancing act between pressure, pride, and quiet obligation. According to Deloitte, 78% of shoppers plan to participate in October and November promotional events to avoid or minimise stress.

Campaigns that recognise this pressure and offer relief, clarity, simplicity, and low-friction options will outperform those pushing magic and excess. Seasonal promotions don’t push buyers; they reassure them.

Campaigns should focus on bundling for value, not discounting. For example, offering a festive dining package with wine pairings or a hotel stay with a spa treatment adds more value without reducing prices. Bundles that reduce friction, like pre-set family-style menus or room upgrades with flexible booking options, and offers that feel like upgrades, such as exclusive access to events or VIP experiences, perform best.

The ideal offer creates a safe, smart, and satisfying decision rather than urgent pressure, like a 'Book Now, Save Your Spot' for group dinners or 'Gift an Experience' gift cards for hotels.

Nostalgia is a powerful sales driver during Christmas, as guests are drawn to familiar flavours and traditions that evoke fond memories. The media plays a key role in amplifying this sentiment, with Christmas films, adverts, and seasonal specials reinforcing the emotional pull of familiar holiday rituals.

Emotional elements, such as family-style sharing platters or personalised handwritten cards with deliveries, create a sense of warmth and familiarity. These thoughtful touches make your guests feel at home, turning a festive meal or stay into a cherished holiday memory.

As consumers lean towards experiential gifting, demand for experience-based gift cards increases, with a 17% growth in digital gift cards in 2024. This trend reflects a 16% expected growth in experiential gifting this year.

💳 Why Digital Gift Cards Are a Key to Success

Mastercard’s SpendingPulse reports a 17% year-on-year increase in digital gift card sales in the hospitality sector for Q4 2023. The digital gift card market is anticipated to grow strongly, with hotel gift cards projected to reach £7.36 billion by 2032, at a CAGR of 12.8%.

This growth is fueled by the shift towards experiential gifting and rising demand for gift flexibility. This growing preference for digital gifts aligns with customer expectations of instant delivery and customisation.

Buyers opt for experience-led vouchers, set-menu dining, and customisable offers that feel thoughtful yet simple. The message conveyed is “I chose this for you,” rather than “I didn’t know what to get you.”

According to Klarna, 65% of Millennials prefer gifting experiences or shared moments over physical items.

Most buyers can be divided into two main categories. The £25–£50 range remains the most popular in food and hospitality as the ‘safe middle ground’. However, high-end experience cards (£100+) are gaining traction, especially for hotel dining, spa menus, or multi-course events. On the other hand, there’s a rise in low-value (£10–£20) digital cards, particularly among Gen Z, used for quick gifts or group experiences. The National Retail Federation reports that 58% of consumers prefer giving digital or experience-based gift cards to convey thoughtfulness while keeping it simple. Buyers want flexible, personal gift cards that minimise the risk of a poor choice. Many are gifting across distances or offering experiences they cannot host themselves.

Interest in these cards typically rises from mid-November, especially for hotel stays, dining experiences, and bundled offers, with demand peaking in the final ten days before Christmas.

🍽️ Group Bookings and What Drives Them

As we head into the 2025 festive season, group bookings will take centre stage, driving a significant shift in how venues prepare for the holiday rush.

With reservations for Christmas up 54% in 2024 compared to 2023, and group bookings of 10 or more rising by 38%, it’s clear that larger gatherings are set to dominate December.

Family schedules during the holiday season have become more diverse, with people juggling multiple Christmas events like office parties, Friendsmas get-togethers, extended family dinners, and even some quiet nights in. This shift influences how and when people make food and travel bookings and what they expect from the experience. Venues that stand out offer hassle-free flexibility and customisable experiences, making the booking process effortless and ensuring guests feel valued from start to finish.

Group sizes vary depending on the venue, with average group bookings ranging from four to eight guests, while larger corporate or family events may host ten to twenty attendees. Spending often correlates with the perceived intimacy of the experience: smaller groups, whether dining in a restaurant or booking a hotel room, tend to opt for premium menus or upgraded seating. In contrast, larger parties usually prefer set menus, communal dining options, or bundled extras that enhance the experience without complicating the process.

Seasonal promotions are effective when they minimise friction. Pre-booked platters, festive drinks, and upgraded room blocks encourage decision-making. The best campaigns present solutions rather than simple invitations. The wording is crucial; “Book now for guaranteed tables together” carries more weight than “Celebrate with us.”

Timing trends are split. High-demand dates, particularly Fridays and Saturdays from late November, often sell out by early October. For instance, Saturday 14 December 2024 was the most popular day for restaurant bookings during the festive period, followed closely by Saturday 7 December. However, smaller groups tend to book between 12 and 20 December, indicating a notable increase in last-minute demand.. A flexible inventory strategy with staggered releases and surprise openings is essential to accommodate both early planners and last-minute guests.

🗝️ Join Me in the VIP Lounge 🔒

Get access to emerging trends, high-impact strategies and a four-wave holiday campaign plan designed to upgrade your marketing before the season peaks.

Don’t play catch-up. Let’s get to work 👇

🔍 Understanding Google’s Role in Holiday Season Planning

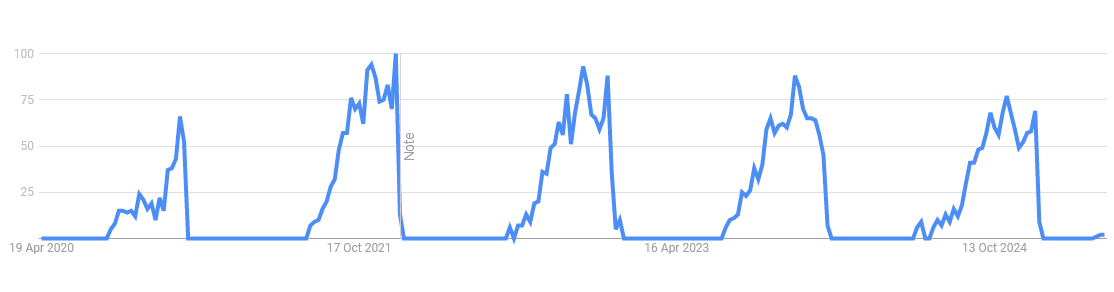

Searches for “Christmas dinner near me” start before summer ends, but most campaigns don’t even exist then. In 2024, “Christmas dinner near me” started climbing in June and peaked in early November, that's four months of intent, long before most venues activate their campaigns. That disconnect costs visibility.

Static menus and once-a-season offers won’t hold attention when guests search weekly. From early planners securing tables for extended family, to last-minute bookers trying to save the day, search behaviour follows emotional state. Timing matters, but so does tone.

By late October, terms shift from “where to go” to “what’s still available”.

In December, searches like “restaurants open Christmas Day” and “last-minute Christmas booking” surge across mobile and Maps.

“Christmas dinner near me” - Google Trends: Global

📝 Christmas Action Plan

Most campaigns collapse under seasonal pressure because they treat Christmas as a single moment. But the season unfolds in four distinct acts—each with its own guest mindset, emotional tempo, and content demand.

Think in waves, not weeks.

Each wave requires unique actions, targeted tactics, and clear deliverables that align with buyer expectations during that phase.

🌊 Wave 1 – Early Planners (June to Early October)

Search intent for Christmas starts building in the summer, so your presence needs to be visible well before festive menus and offers are finalised. Whether you're a hotel or a restaurant, laying the groundwork early is key:

Google Maps (June): Update your Google Maps listing with photos and videos from previous Christmas events, seasonal menus, or hotel offerings like festive stays or holiday spa packages.

Pinterest & Instagram Collection (July - November): Start creating and sharing inspirational content for early planners. Develop visual boards featuring "Christmas Table Settings," "Holiday Getaways," and "Gift Experience Ideas" to position your brand as part of their long-term holiday plans. For hotels, also include "Winter Escapes" or "New Year’s Eve Getaways."

Email Teasers (October): Send "save the date" emails to your existing customers featuring a sneak peek of your holiday offers, whether festive dining, exclusive packages, or holiday stays. Focus on curiosity over details. Example: “Get ready for unforgettable Christmas dining and holiday stays. More details coming soon!”

Soft Launch Menus (October): Release a “soft open” Christmas menu or package, whether a holiday dining experience or memorable hotel stays. Focus on showcasing a few key items or offers, rather than everything. The goal is to build anticipation and get your offerings saved to potential guests’ “wish lists.”

Google Maps & Third-party Listings (October): Ensure your Google My Business, booking platforms (e.g., OpenTable, Resy for restaurants; Booking.com, Expedia for hotels), and influencer partnerships are live by early October.

🎁 Wave 2 – Gift-Driven Guests (Mid-October to Early December)

This is the conversion phase. Guests move from curating to choosing. It’s time to make their decision easy, comfortable, and without friction.

Create unique landing pages for each type of offering (e.g., festive dining, hotel stays, spa packages, group bookings). These are dedicated web pages that cater to different customer needs and preferences. Include clear calls to action like 'Book Now,' 'Available for Gifting,' and 'Gift an Experience.' To make the booking process easier, offer filters that allow guests to personalise their experience, such as dietary preferences, party size, room types, or the type of atmosphere they prefer (e.g., quiet dining vs. communal tables, or a relaxing spa treatment vs. an active holiday package).

Playlist Teasers: Share holiday playlist previews on Instagram or TikTok that feature your restaurant’s or hotel's ambience. Encourage followers to save and share.

Offer Reveals: Run weekly teaser campaigns showing behind-the-scenes looks at your seasonal menu items or hotel room upgrades for the holidays. Use Instagram Stories or Reels to build excitement.

Availability Nudges: Use email campaigns to update customers on limited availability, especially for high-demand dates. Example: 'Only 4 tables left for Christmas Eve dinner—book now to secure your spot' or 'Limited rooms available for New Year’s Eve—reserve now before they’re gone.'

Emotional Segmentation: Divide your email list by buyer persona (e.g., family planners, solo travellers, corporate clients) and tailor content accordingly.

For Family Planners: Focus on sentimental offers like ‘family-style menus’ or ‘shared holiday experiences’ for dining and hotel stays.

For Solo Diners or Couples: Highlight intimate, quiet dining experiences or solo indulgence offers, such as romantic getaways or relaxing spa packages for two.

⏰ Wave 3 – Last-Minute Decision Makers (10th to 24th December)

This wave targets buyers who are making last-minute decisions. They value straightforward, clear offers that allow them to secure bookings without fuss.

Countdown Timers: Use countdown timers on your website and in emails. For restaurants: “Only 2 tables left for Christmas Day!” For hotels: “Only a few rooms left for New Year’s Eve—book now!” Or, “Gift cards available for immediate email delivery—last chance!”

QR Signage & Real-Time Updates: Place signage in your venue promoting “last-available tables” or “last-minute rooms” for walk-in customers. Digital screens or QR codes can allow guests to make immediate bookings for dining or stays.

Social Ads & Retargeting Campaigns: Promote last-minute gift cards and availability updates. Show ads to people who have previously visited your site but didn’t make a reservation—remind them of limited spots available for dining and stays.

Budget-Friendly Messaging: Position your offerings as “Easy indulgence without the stress.” Highlight how your restaurant or hotel is the perfect option for last-minute plans, offering a straightforward, enjoyable experience without needing long-term commitment.

🧠 Wave 4 – Memory-Stage Returners (26th December to Early January)

You can build loyalty by staying engaged when others step back. Buyers are in a reflective mood and seeking more thoughtful, meaningful interactions.

Gratitude Emails: Show appreciation to your guests by sending thank-you emails for their loyalty throughout the holiday season. Remind them to redeem their gift cards or book for future experiences, whether it’s a dining experience or a relaxing hotel stay. Use personalised subject lines like “Thank you for celebrating with us—here’s a gift for your next visit.”

Post-Holiday Special Offers: Keep the momentum going by promoting “leftover indulgence menus” or exclusive offers for returning guests. For hotels, you could offer something like, “Start 2026 with a 15% discount on your next stay or dining experience.” For restaurants, highlight special seasonal menus or discounted packages.

Email & SMS Reminders: Send reminders for unused gift cards and their expiry dates, along with ideas for making the most of them after Christmas. Suggest using the gift cards for spa days, staycations, or even New Year’s Eve celebrations at your hotel or a festive dinner at your restaurant.

VIP Program Invitations: Reward loyal guests by offering them VIP membership for exclusive access to your venue. Encourage them to join for special offers in 2026, whether for priority reservations at your restaurant or early-bird access to your hotel’s seasonal packages.

⭐️⭐️⭐️⭐️⭐️

Christmas preparation begins soon! Your buyers are starting to plan, and so should you. By the time December rolls around, most venues will be playing catch-up. The opportunity to secure your place on their holiday radar starts months earlier.

The demand for memorable experiences is clear. Guests choose what to gift and share, not just what to buy. The trend towards digital gift cards is undeniable, with experience-led vouchers gaining massive traction. This is your chance to offer something flexible and thoughtful. Digital gift cards are not just for last-minute shoppers—they are a strategic tool that taps into the rise of experiential gifting.

Don’t wait until the last minute to launch your holiday campaigns. Your guests are already planning their festive experiences. Show them what you can do!

All the best

Dawn Gribble MIH MCIM

Hospitality Marketing Insight

Here’s to Your Success 🥂

📅 Coming Up

In the next issue, we’ll explore how to stop measuring reach and start building loyalty through strategic brand communities. You’ll learn why emotional engagement trumps follower count and how to design a community that keeps customers returning. Ready to turn your audience into a true brand community?

❓ Got a question about this issue?

If something in this issue sparked a question or highlighted a challenge you're facing, feel free to reach out in the comments below. With over 20 years of experience in hospitality marketing, I’m here to provide you with actionable answers.

📚 Recommended Resources

Credence Research. UK Hotel Gift Cards Market Size, Growth and Forecast 2032 (2025).

Deloitte. Deloitte: Holiday Shoppers Expected to Increase Spending (2025).

Deloitte Insights. 2024 Deloitte Holiday Retail Survey (2025).

Google Trends. Google Trends (2025).

Hotel Gift Cards Market Size, Industry Analysis & Forecast, 2033 (2025).

Hotel Gift Vouchers: 43% Purchased during Christmas Season (2023).

Mastercard SpendingPulse: Total U.S. Retail Sales Grew 3.8%* This Holiday Season; Online Remained Choice for Consumers, Increasing 6.7% YOY (2025).

Over 64% of Guests Use Gift Cards to Discover New Restaurants [2024 Gift Card Data] (2025).

Mastercard Data & Services. SpendingPulse™ (2018).

Wilkinson, Joe. Digital Gift Cards Overtake Physical Cards for the First Time. Garden Centre Retail (blog) (2024).

Young People Most Stressed about Spending Family Time This Christmas | Mintel (2025).