📌 January Strategic Update

Insights Every Hotel & Restaurant Should Act On

How can we combat the Q1 slump without discounting? How can we create mid-week demand? And how can we adjust our marketing strategies to succeed in 2026?

🌞 Hello and Welcome To Hospitality Marketing Insight

I’m your host, Dawn Gribble, and this week we’re exploring the dangers of discounting in January, what wellness guests actually want, plus value-added campaign ideas.

January is typically a low-demand month where consumers are fiscally cautious and rebalancing after the holidays. Spending growth at restaurant chains fell by 1.7% in January 2025, and independent restaurants saw a 2.6% decline. Hotels are experiencing similar pressure, with studies showing that properties that discounted against their competitive set recorded lower RevPAR even when occupancy increased.

It’s a month that pushes people to reset their habits, leading them to seek places that feel good for both their well-being and their wallets. 84% of consumers expect to reduce their spending over the next six months, and 52% plan to cut dining out. Demand is low, costs stay high, and guests lean heavily into wellness, moderation and value-driven choices.

While discounts might seem like a natural response to a slow season, using them aggressively or universally carries significant risks.

What you do in January sets expectations for the rest of the year

📄 On the Menu this week

Why January Discounting Damages Revenue Integrity and Long-Term RevPAR

Cognitive ROI in Hospitality: How Reduced Mental Load Drives Guest Satisfaction and Spend

Wellness Intent vs Behaviour: What January Guests Plan, What They Do, and How Hospitality Should Respond

How to Increase Midweek Hotel and Restaurant Demand Without Discounting

Latest Platform Updates

Marketing Dates for your Diary

Quick Wins for Q1

Let’s Check In ☕

👉 The full breakdown is best read online continue reading here

⚠️ Why January Discounting Damages Revenue Integrity and Long-Term RevPAR

January creates a predictable temptation to cut prices. 57% of shoppers expect the economy to weaken in the next six months, the most negative outlook since 1997, and holiday travel budgets have dropped 18% year-over-year. This creates a landscape where guests enter the month financially cautious, scanning for lower prices and engaging in deal-seeking behaviour. 70% of shoppers are already engaged in value-seeking, and 95% of younger generations are actively seeking deals, heightening the risk that a discounted January rate becomes their benchmark.

But when discounts become the primary message in January, guests begin to doubt the integrity of standard pricing. For example, when a guest sees a room at £98 in January, that number becomes the reference point they carry forward. Returning to the normal £145 rate later in the year suddenly feels expensive, even if £145 has always been the standard.

This psychological anchoring effect means a short-term dip in rate can fix a low price in the guest’s mind for months. A deep reduction implicitly asks: “Was this overpriced before?” The wider financial context deepens this effect. 43% of consumers plan to decrease discretionary spending over the next three months, and 51% have already reduced discretionary spending, which means guests are primed to interpret lower prices as the “true” value. Younger generations planning to spend 34% less than last year are particularly likely to hold on to the lowest price they encounter and anchor against it for the rest of the year.

Discounts also influence the type of customer you attract. Heavy or frequent reductions tend to pull in price-loyal guests who choose the lowest available rate, not the brand. These customers are less likely to return at full price and often spend less on high-margin services such as spa treatments, bars or signature dishes. Over time, this can depress both Average Daily Rate and Average Check Value even when volumes appear healthy.

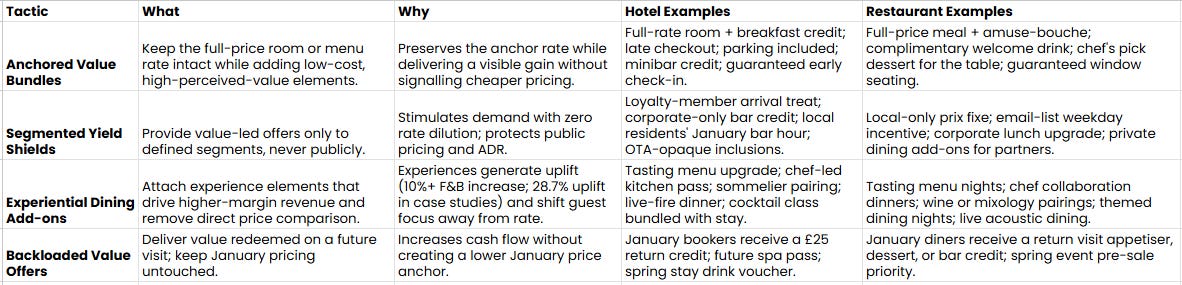

Successful operators use targeted tactics that preserve the price anchor while still giving guests a compelling reason to book. This includes value-added packages where the room rate remains intact, but high-perceived-value extras are included. It also includes segmented offers for loyalty members, locals or corporate clients, which fill low-impact inventory without broadcasting a lower public rate.

Experiential approaches work particularly well at this time of year. Themed breaks, resolution-led packages and other purpose-driven experiences allow operators to introduce new product lines at premium price points. Hotels that offer unique dining experiences see an average 10% increase in F&B revenue, and 87% of guests say dining experiences directly influence their satisfaction. Case studies show experiential dining concepts can lift revenue by 28.7% in just a few months, removing direct price comparison and giving guests something aspirational to engage with.

Because these risks compound, your focus in January should shift from price cuts to value creation.

You Need a Value Added Strategy

January requires offers that protect the price anchor while still giving guests a compelling reason to book. The most effective tactics increase perceived value without lowering the base rate, ensuring guests remain confident in the normal pricing structure. Behaviour-led packages, anchored bundles and segmented incentives outperform discounting because they create gain without signalling cheaper pricing. Hotels that offer unique dining experiences see an average 10% increase in F&B revenue, and 87% of guests say dining experiences directly influence satisfaction, reinforcing the commercial strength of experience-first value creation.

A well-constructed value strategy does more than protect your pricing, it shapes how guests feel about spending. When operators shift from transactional discounts to experience-led value, they activate a different decision pathway, one driven by emotional reward rather than price reduction. This is where Cognitive ROI becomes commercially powerful, as the guest’s perception of gain begins to outweigh the rational cost of the stay or meal.

😌 Cognitive ROI in Hospitality: How Reduced Mental Load Drives Guest Satisfaction and Spend

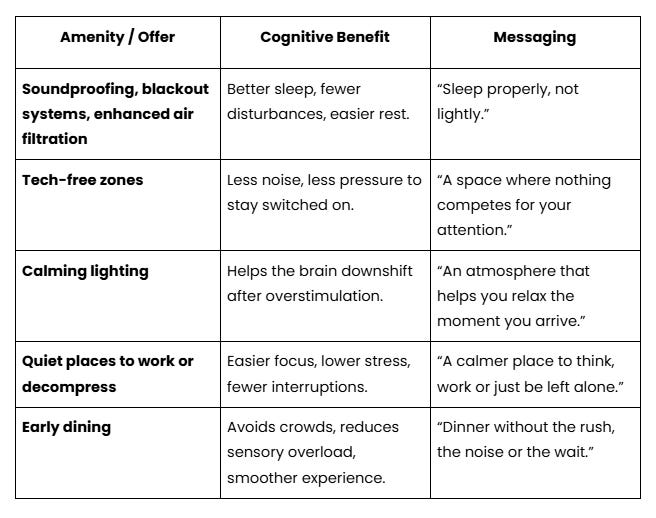

January places unusual pressure on people’s cognitive bandwidth. After weeks of disrupted routines, social obligations and heightened sensory load, guests enter the new year looking for environments that feel calmer, clearer and easier to navigate.

Hotels and Accommodation

For hoteliers, mental space is already a premium amenity, yet it remains under-marketed. The focus should shift from the physical assets to the practical results of rest. Features such as soundproofing, blackout systems or enhanced air filtration support deeper sleep and cognitive restoration, and these specifics matter more than broad claims of tranquillity.

Tech-free zones in lounges or certain rooms create an intentional break from the digital load guests carry into the new year. When presented as a thoughtful choice rather than a restriction, they reinforce the idea that January stays are a reset, not an obligation. This is already happening in the market: 23 Hotel in Medellín offers a fully structured “Digital Detox Experience” with device-free public spaces, guided activities that replace scrolling and personalised disconnection plans, while Inhabit Hotels in London runs January stays centred on mindful digital reduction, quiet communal areas and lighting designed to encourage calm over stimulation. Both examples show how operators can package mental space as a tangible, bookable benefit.

Restaurants and Local Venues

A notable share of guests now ask directly for quieter places to talk, work or decompress. This need can be met and monetised through deliberate signalling. Naming a designated area—such as a Quiet Corner or Calm Section—sets the expectation that the space offers low background music, softer lighting and unhurried service. These cues support focused conversations, solo work and sensory-friendly dining. Clear naming also reduces friction for guests who prefer calm but do not want to request special treatment. For example, guests can select a Quiet Corner directly in the booking journey, removing the need to request a quieter table.

Corporate and Early-Evening Framing

The same principle applies to group and corporate bookings. Many teams enter January with depleted energy and a desire to socialise without the cost of late nights. Early seating between 5:30 pm and 7:00 pm becomes a benefit when framed around ease: simple to reach after work, home by 9:30 and no next-day fatigue. Positioning early dining as a deliberate choice respects the mental load of teams recovering from a demanding quarter.

Mental Space as a Premium Amenity

Mental space is a differentiator in January because it meets a genuine psychological need. Guests are not only seeking hospitality; they are seeking clarity, calm and cognitive ease after an overstimulating season. Restaurants can sell calm as a defined experience, and hotels can elevate quietness into an explicit, outcome-focused value proposition.

🧘♀️ Wellness Intent vs Behaviour: What January Guests Plan, What They Do, and How Hotels Should Respond

There is a growing gap between how guests plan for wellness and how they actually behave once they arrive. The intent is high at the moment of booking, but the execution collapses during the stay. That conflict is becoming one of the most important behavioural patterns in hospitality.

Analysis shows a clear surge in aspirational wellness activity in January, driven by resolutions such as Dry January or healthy eating. 42% of people choose healthier eating as a New Year’s resolution, and 44% of US consumers participated in Dry January last year. Among Gen Z, 75% say they are somewhat likely to take part. Guests book wellness packages, ask about gym access and choose “good” options on menus because the act of planning satisfies their desire to commit to a healthier identity. Pre-trip happiness is also measurably higher for travellers (M=2.25 vs 2.07), indicating that the anticipation of “being better” provides its own psychological reward.

Once the stay begins, emotional and habitual needs take over. Internal data shows a marked increase in indulgent behaviour: late-night comfort food orders, skipped gym sessions, unused spa slots, and far less engagement with the activities they were motivated by at booking. The intention belonged to their idealised future self. The behaviour reflects their present-tense need for rest, comfort and relief. This is often compounded by the fact that 58% of shoppers find the holiday period stressful, and two-thirds of Americans report sleeping better in hotels, suggesting guests use stays primarily as recovery rather than discipline.

This is the core dissonance: the guest wants to be healthier, but they do not want to be disciplined during their limited leisure time. They want the feeling of improvement without the effort required. Research shows that only “very relaxed” holidays improve post-trip happiness, and that travellers with lower coping ability experience the strongest wellbeing gains when the experience prioritises ease over effort. Recognising this tension is essential because the value for operators does not sit in enforcing wellness; it sits in resolving the dissonance without judgment.

The most effective strategy is to create hybrid wellness experiences that honour the guest’s intention while accommodating their emotional reality.

“Healthy-ish” Menus: Dishes that balance wellbeing with comfort. Not restrictive. Not moralised. Options that let the guest feel they made a healthier choice without sacrificing pleasure.

Digital Rest Areas: Instead of strict detox programmes, offer designated and marketed “Digital Rest” spaces. Quiet, device-free zones framed as a premium amenity rather than a behavioural demand. This aligns with the fact that 89% of wellness travel is “secondary wellness,” where guests want healthier environments without committing to structured programmes.

Value-Added Wellness: Packages that prioritise restoration over discipline. Complimentary yoga or meditation, a discounted spa treatment, a premium non-alcoholic drink on arrival, late check-out. Support, not enforcement. The sleep tourism market is now USD 74.54B and projected to almost double by 2030, demonstrating the rising value placed on rest-focused experiences.

By meeting the guest where they actually are, rather than where they imagine they will be, operators bridge the gap between intention and behaviour. The guest leaves feeling satisfied: they fulfilled the commitment they made at booking and enjoyed the comfort they needed during the stay. That alignment is what drives memory, loyalty and long-term value.

💡 Ask Dawn: How Do We Build Mid-week Demand?

This week’s question comes from Bruna, who asked how to strengthen mid-week trade. Here are some proven tactics that consistently improve performance from Tuesday to Thursday.

Give People a Reason to Come Out Mid-Week

Mid-week works when there’s a specific pull.

Cooking classes

Wine or mocktail pairing dinners

Local collaboration nights

Chef demonstrations

Small-format live music

Seasonal themes

These create a moment people plan for, rather than leaving it to chance.

Make Group Bookings Effortless (One-Screen Menu)

Organisers need something they can screenshot, share and approve quickly.

One-screen menu on your website + Google Business Profile

PDF + one square shareable image

Price per person in the first line

One line explaining inclusions (bread, sides, coffee)

Three mains max, clear veg/GF tags

Keep descriptions to 8–12 words

Mark one option as Best for groups

One action path only (booking link or phone)

Clear RSVP cut-off: RSVP by Mon 6 pm

Tip: If people have to Zoom in to see the details, it’s costing you bookings.

Use a One-Sentence Nudge When Group Enquiries Go Quiet

If a group enquiry stalls, the organiser is usually overwhelmed or waiting for internal approval.

Send one sentence that gives them a small win:

Host perk (free drink, dessert, or a small upgrade)

Group size minimum (e.g., 8+)

Tue–Thu only

One action path first

20–25 words

Clear deadline: RSVP by Mon 6 pm

Post the same line on your Google Business Profile and as a pinned comment under your mid-week posts. Perks outperform discounts mid-week because they feel like a gain, not a markdown.

Sell the Calm — Make Quiet a Product

People are actively searching for calmer places to talk, work or decompress.

Turn this into a mid-week advantage:

Name it everywhere: Quiet Corner or Calm Section

One-line expectation: low background music, softer lighting, unhurried service

Publish the calm hours: Tue–Thu 3–6 pm

One photo, no faces

Practical comforts: strong Wi-Fi, plug points, supportive seating

Invite sensory preferences at booking

Naming converts better than vague atmosphere words.

Speed Up Budget Sign-Offs With Simple Maths

Groups often stall because someone needs to justify the numbers easily.

Put £ per guest in the first line

One-screen menu only

One line of inclusions

Ready maths for common sizes: 8 × £25 = £200; 12 × £25 = £300 (+ service)

Repeat the price in the subject line

Add an RSVP deadline next to the price

If they don’t have to think, they move faster.

Offer Early Corporate Seating (No Discount Needed)

Teams are tired. Early dining feels considerate, not restrictive.

Position 5:30–7 pm as the benefit:

Easy after work

Home by 9:30

Still feels like a proper occasion

No next-day fatigue

It’s respect for people’s energy, not a deal.

Build One Weekly Habit That Belongs to You

Mid-week strengthens when there’s something people return for.

A Wednesday dish

A Thursday pairing

A set-price dinner hour

A consistent ritual your neighbourhood learns to expect

Routine builds habit. Habit builds revenue.

With mid-week strategies covered, let’s move into this month’s platform updates and what they mean for your visibility.

📈 Hospitality Platform Updates You Need to Know for Q1 Performance

Across Google, Meta, TikTok and the wider ecosystem, platforms are simplifying layouts, introducing agentic capabilities and prioritising content that machines can read without ambiguity. AI is becoming the primary decision layer, which means structured information now matters more than personality, storytelling or visual style. The operators who adapt early will be surfaced more often, while those who rely on older content formats will see declining visibility without any warning.

Below is a briefing of the updates that matter, clustered by platform so you can see where attention is moving and what will shape reach over the next quarter.

📘 Facebook

Facebook Simplifies Page Creation And Categorisation For Creators And Brands LINK

Facebook Groups: Admins Can Switch From Private To Public While Protecting Member Privacy LINK

🔍 Google Search, Ads, Maps And Commerce

Google Ads Adds “Investment Strategy” Tab To Show Impact Of Higher Budgets LINK

Google Ads Launches Text Guidelines To Steer AI-Generated Ad Copy To Brand Tone LINK

Google AI Mode Gains Agentic Capabilities For Booking Events, Beauty And Wellness Appointments LINK

Google Tests “Track Price Changes By Email” On Local Hotel Listings LINK

Google Compares Local Services Ads Versus Search Ads For Local Lead Quality LINK

Google Maps Shares 2025 Holiday Timing And Visit Trends For Key Locations LINK

Google Maps Adds Gemini-Powered Landmark Navigation And Smarter Directions LINK

Google Maps Rolls Out Gemini Navigation Wherever Gemini Is Available LINK

Google Merchant Center Adds “Creative Content” Section To Attach Video Assets To Products LINK

Google Launches “Google Skills” AI And Tech Training Hub (Many Courses Free) LINK

Google Tests Reviews Services Summary Box To Surface Key Service Attributes In Search LINK

Google Details Ongoing Efforts To Simplify The Search Results Page Layout LINK

Google Reminds Businesses To Use New Form Against Negative Review Extortion Scams LINK

🎥 YouTube

YouTube Adds “Hype” Posts And Members-Only Filters To Highlight Key Creators LINK

YouTube Updates CTV Presentation And Introduces AI Upscaling For TV Viewing LINK

YouTube Tightens Rules On Violent Gaming And Gambling-Related Content LINK

📸 Instagram

Instagram Adds Competitor Insights Dashboard For Professional Accounts LINK

Instagram Lets Users Draw On DM Chats With New Creative Tools LINK

Instagram Introduces Reels Watch History So Users Can Revisit Previously Viewed Videos LINK

🧵 Threads

Threads Launches Disappearing “Ghost Posts” That Auto-Archive After 24 Hours LINK

Threads Adds Reply Approvals And Activity Feed Filters To Manage Engagement LINK

Threads Introduces Time-Management And Sleep Settings To Curb Overuse LINK

Threads Reaches 150 Million Daily Active Users And Expands Ad Options LINK

Threads Adds Podcast Integration And Preview Cards To Profiles LINK

💼 LinkedIn

LinkedIn Pledges Crackdown On Engagement Pods And Fake Interaction Schemes LINK

✉️ WhatsApp

WhatsApp Makes End-To-End Encrypted Chat Backups Easier With Biometric Lock-In LINK

WhatsApp Plans Usernames So People Can Chat Without Revealing Phone Numbers LINK

📌 Pinterest

Pinterest Adds AI-Powered Board Recommendations To Surface More Relevant Pins LINK

👻 Snapchat

Snapchat Partners With Perplexity To Bring Conversational AI Search Into Chat LINK

Perplexity AI Chatbot Will Appear In Snapchat Inboxes Alongside My AI LINK

Snapchat Briefs Marketers On New Holiday Shopping Campaign Opportunities LINK

Snapchat Publishes New Research On Gen Z Gifting Trends And Occasions LINK

🎵 TikTok

TikTok Adds AI Assistance Tools For Creators And Expands Subscription Revenue Options LINK

TikTok Officially Launches Bulletin Boards As Broadcast-Style Messaging Channels LINK

TikTok Shares Cybersecurity Tips And Policy Enforcement Updates Around Scams LINK

TikTok Shop Kicks Off Its Biggest Integrated Holiday Shopping Season To Date LINK

🗺️ Yelp

Yelp Launches AI Tools To Respond Faster, Capture Leads And Engage Customers In Real Time LINK

🤖 OpenAI

OpenAI Launches ChatGPT Atlas Web Browser With Built-In Search Based On Google Results LINK

🗓️ Marketing Dates For Your Diary January 2026

🌟 Month-Long Campaigns (January 1 - 31)

Dry January: Focus on Non-Alcoholic (NA) Cocktails and wellness beverages.

Veganuary: Offer special, clearly marked Vegan Menu items or specials.

National Hot Tea Month: Promote afternoon tea, specialty teas, and tea-infused items.

National Soup Month: Run daily soup specials or a tasting flight.

📅 Daily Opportunities

January 1: New Year’s Day / National Bloody Mary Day

January 2: National Science Fiction Day

January 3: National Chocolate Covered Cherry Day

January 4: National Spaghetti Day

January 5: National Whipped Cream Day / Twelfth Night

January 6: National Shortbread Day / Epiphany (Three Kings’ Day)

January 7: National Bobblehead Day

January 8: National English Toffee Day

January 10: National Oysters Rockefeller Day

January 11: National Hot Toddy Day / National Milk Day

January 12: National Hot Tea Day

January 13: National Sticker Day

January 14: National Dress Up Your Pet Day

January 15: National Strawberry Ice Cream Day

January 16: International Hot and Spicy Food Day

January 17: National Hot Buttered Rum Day

January 19: Blue Monday

January 20: National Cheese Lovers Day

January 21: National Hugging Day

January 22: Get to Know Your Customers Day (4th Thursday)

January 23: National Pie Day

January 24: International Day of Education / National Compliment Day

January 25: Burns Night (Scotland) / St Dwynwen’s Day (Welsh Valentine’s)

January 26: Australia Day / International Customs Day

January 27: National Chocolate Cake Day

January 29: National Puzzle Day

January 30: National Croissant Day

January 31: National Hot Chocolate Day

☀️ Dawn’s Expert Insights

The Slump

Most people talk about “the January slump” as if it were flat. The pattern looks more like:

Sharp fall in the first full week back at work and school.

Short mid-month recovery as people start going out again.

Another dip triggered by external shocks (weather, strikes, late-month money worries).

Very few operators design three different January plays for those phases. Most run one generic offer all month.

Dry January Starts in December

The industry conversation is still “how to survive Dry January.” The data says:

Moderation behaviour has moved into December and is spread across the year.

January is no longer the unique “abstinence month”; it is one point in a longer moderation arc that starts pre-Christmas.

So the clever move is not a one-month mocktail push. It is a December–February moderation journey: menus, rituals and messaging that normalise mixing alcohol and low/no, not just abstaining for four weeks.

Plan Your Year Campaigns

January on-property feels dead, but January in people’s heads is hyper-active. Guests are using hospitality as a future-self purchase: they buy hope and control in the form of a trip or stay. That is why you see heavy holiday booking activity even while local pubs and restaurants are reporting flat or falling trade.

Very few local operators use January as their primary “plan your year of stays/meals” month. They market for immediate covers and heads in beds. A machine looking at these data sets together would tell you that January is for selling future hospitality with a strong emotional frame, not just this week’s table.

⭐️⭐️⭐️⭐️⭐️

Thank you for spending this time with me. If you take one thing forward, let it be this: the operators who understand January’s behavioural patterns set the tone for the rest of the year. You now have the insight and the tools to do that with confidence.

I’ll have a fresh serving of insights ready for your next visit.

All the best

Dawn Gribble MIH MCIM

Hospitality Marketing Insight

Here’s to Your Success 🥂

📚 Sources

9 Winter Marketing Ideas to Keep Your Restaurant Bustling, SevenRooms (n.d.)

AI agents will be ‘gatekeepers of loyalty’ in hospitality: study, Hotel Dive (n.d.)

Brzozowicz, M., Krawczyk, M., Anchors on prices of consumer goods only hold when decisions are hypothetical, PLoS One (2022)

Canina, L., Enz, C.A., Lomanno, M., Why Discounting Doesn’t Work: A Hotel Pricing Update, Cornell University (2006)

Digital Detox Experience at 23 Hotel Medellin, 23 Hotel (2025)

Deloitte: While Holiday Travel Intent Rises, Planned Spending Hits Turbulence, Deloitte (n.d.)

Gabler, C.B., Myles Landers, V., Reynolds, K.E., Purchase decision regret: Negative consequences of the Steadily Increasing Discount strategy, Journal of Business Research (2017)

Gribble, D., The Menu Mistakes Draining Your Margins, Hospitality Marketing Insight (2025)

Inhabit Team, Unplug and Reconnect: A Digital Detox Stay at Inhabit Hotels, Inhabit Hotels (2025)

Mulcahy, R., Prayag, G., Pourfakhimi, S., Enhancing Quality of Life through Travel, Happiness, and Psychological Resilience: The Influences of Coping and Vulnerability, Journal of Travel Research (2024)

Nawijn, J., Marchand, M.A., Veenhoven, R., Vingerhoets, A.J., Vacationers Happier, but Most Not Happier After a Holiday, Applied Research in Quality of Life (2010)

PricewaterhouseCoopers, Holiday Outlook 2025, PwC (n.d.)

Psychology of Discounts and Perks: Driving Sales & Loyalty, Paylode (n.d.)

Sampaio, C., Sebastião, J.R., Farinha, L., Hospitality and Tourism Demand: Exploring Industry Shifts, Themes, and Trends, Societies (2024)

Sleep Tourism Market Size & Share, Grand View Research (n.d.)

State of the Restaurant Industry Report: Data & Statistics, Bank of America (n.d.)

The Economic Impact of Dry January, NA Beer Club (n.d.)

Trakas, M., Journeying to the past: time travel and mental time travel, how far apart?, Frontiers in Psychology (2023)