📌 Hospitality’s November Strategic Update — Action Plans Inside

Discover the booking triggers that drive families, friends, and corporate groups this season. Read now to access the playbook.

🌞 Welcome To This Week's Newsletter

The festive run-up is here, and the choices guests make in the next few weeks will decide who wins the season and who gets left behind. Black Friday campaigns lifted hotel bookings by 64% last year, while OpenTable reports group reservations up 8% year-on-year. Together, these shifts indicate that timing and group focus are the key levers driving Q4 revenue.

📄 On the Menu this week

November Seasonal Triggers

Group Behavioural Drivers

Marketing to Groups Strategy

Marketing Intelligence Report

November Marketing Dates

Strategic Action Plan

Let’s Check In ☕

🍂 November Seasonal Triggers

In November, consumers are primed for offers, travel searches climb, and festive planning begins in earnest. For hospitality, this creates a window where Black Friday and Travel Tuesday act as catalysts, turning seasonal curiosity into bookings and gift card sales.

Black Friday and Travel Tuesday are moments when guests actively seek deals and experiences, providing hotels and restaurants with a ready-made opportunity to capture attention. These events effectively boost occupancy during slower periods, bridging the booking gap between late November and December.

🛍️ Black Friday

What started as an online shopping day in the early 2000s, Black Friday has transformed Q4 consumerism into opportunities for both hotels and restaurants.

In 2024, hotels with Black Friday campaigns saw a 63.8% increase in website bookings, showing success in attracting and securing guests. A report by The Hotels Network found that hotels without campaigns saw a 1.2% drop in direct bookings.

Not only that, but hotels with Black Friday campaigns had 9.2% more unique visitors than in October and a 36.7% jump in people searching for stays through their booking engines. In contrast, hotels that did not run these campaigns saw a 4% decrease in visitors.

For restaurants, the story is similar. Restaurant gift card sales peaked in the 2024 Thanksgiving weekend, with shoppers purchasing 13.2% more in dollars per card on Black Friday and 17.7% more spent over the weekend.

In 2025, early sales data and consumer surveys point to another surge in physical gift card demand, particularly around the Black Friday weekend. Families and friend groups favour in-store purchases that they can present as tangible gifts, while restaurants and hotels are promoting bundled offers to capture this interest.

✈️ Travel Tuesday

Created in 2017, Travel Tuesday takes place on the Tuesday after the US Thanksgiving, serving as the travel industry's equivalent of Black Friday. This year, it falls on Tuesday, December 2, 2025.

Over the last 4 years, search interest has risen by more than 500%, expanding from its North American base into the UK, the Netherlands, Spain, and Australia. In contrast, Asia shows little engagement with Travel Tuesday, as China’s Singles Day dominates the seasonal shopping calendar in the region.

Airlines, hotels, tour operators, and agencies regularly participate, with brands releasing exclusive offers such as up to 50% off hotel stays, bundled packages, and unique flight deals. According to FareHarbor, flash discounts, bundles, and cross-promotions help boost results, with deals often going live late Monday night.

But Travel Tuesday isn’t only about flights and hotel deals. Food now drives travel decisions just as strongly, with culinary tourism worth over $1 trillion and growing fast. More than half of global travellers prioritise dining when planning trips, and 1 in 2 now book restaurants before flights. For Gen Z and Millennials especially, food is the starting point, with trips often built around dining experiences.

For restaurants, this is a clear opening. Travel Tuesday can be used to package dining as part of the journey: seasonal tasting menus, bundled stays with reservations at partner restaurants, or culinary add-ons such as wine tastings and chef-led tours. For hotels, highlighting on-site dining or partnerships with local food venues gives campaigns broader appeal and positions the property as part of the food itinerary.

🎁 Gift Cards

Gift cards are widely used across hotels and restaurants, providing buyers with a simple way to gift experiences, while operators benefit from upfront revenue and increased customer reach. They remain one of the most popular holiday purchases, with demand peaking around Black Friday and extending into December.

Hotels are increasingly using them too, not just for room nights, but also for on-site restaurants, spa breaks, and bundled experiences. A single card can cover dinner at the hotel restaurant, a weekend stay, or a wellness package, making them flexible and attractive for both givers and guests.

The global gift card market is projected to reach $510 billion in 2025, with restaurants accounting for 30% of food and beverage sector sales. The U.S., Canada, U.K., Australia, and Germany lead the way in usage, but demand is strong across most major hospitality markets. Consumers are drawn to gift cards for their flexibility, and nearly two-thirds buy them specifically for holiday gifting.

When it comes to format, physical cards remain the dominant choice. More than half of consumers say they prefer physical cards, while only a small minority opt for digital versions. Older guests are especially keen on physical formats, perceiving them as more suitable, while younger professionals show greater openness to digital cards.

Seasonal design is also a factor, with over 40% of holiday shoppers opting for cards featuring festive or winter-themed images.

Most buyers still look to a brand’s website for information and purchase options, so it’s essential to feature gift cards across websites and booking engines clearly.

Toast research shows that around 83% of 18–24-year-olds use their gift cards to dine in. Older demographics also tend to prefer dine-in options, showing that gift cards are often tied to experiences rather than convenience.

Gift cards create opportunities for both discovery and loyalty. Almost two-thirds of recipients report discovering a new restaurant through a gift card, and 71% say they feel more loyal to a brand after receiving one. In the 2025 festive season, 64% of consumers plan to purchase at least one gift card, with restaurants and hotels among the top categories.

🤝 Behavioural Drivers - Group Marketing

Group bookings are surging into the 2025 holiday season. 47% of travellers say they plan multigenerational family trips at this time of year, and over 40% intend to travel with a partner or family. Around 20% plan trips with friends.

Restaurants are tracking the same trend. OpenTable data from September 2025 shows an 8% rise in reservations for parties of 6 or more. Mid-size and large gatherings are also returning midweek (as well as at weekends), with Wednesday seated dinner counts up 11% year-on-year, the sharpest increase of any day.

👨👩👧👦 What Groups Want in Q4

Behind the rise in group demand are three segments with very different expectations: families, friends, and corporate groups.

Families

Families are searching for ways to make festive gatherings easier and more inclusive. Search data indicates a growing interest in “family all-inclusive” and “child-friendly festive dining,” with parents seeking packages that align with school holidays and Black Friday promotions.

Travel remains at the heart of family behaviour in Q4. 83% of holiday travellers said they were on the move to visit family or friends between Thanksgiving and New Year. Christmas and New Year’s breaks are also global drivers, with families booking hotel stays, city breaks, and resort packages to make gatherings more special. The multigenerational trend is clear: 58% of Millennial and Gen Z parents plan to bring extended family on holiday in 2025, compared with just 31% of Gen X and Boomers.

When dining out, families typically book moderately sized groups. Research from Costar shows that 37% expect to dine in parties of 6–10 people and 39% in parties of 3–5, while only 9% plan groups larger than 10. Venues that can comfortably seat mixed groups of grandparents, children, and visiting relatives have the strongest appeal. Demand is also strong for at-home group dining.

In September 2025, Deliveroo introduced Family Dineroo, working with more than 30 UK restaurants, including wagamama and PizzaExpress, to create shareable menus priced at £25 or less. These thoughtfully crafted multi-portion dishes cater to families and mark a well overdue step towards enhancing the at-home group dining experience.

Families want quality time together without the stress of cooking and cleaning. 72% say eating out gives them more time to connect, and 82% say it reduces holiday pressure. Support for local venues is also essential, with 88% of respondents expressing a positive attitude towards choosing local restaurants for their holiday meals. At the same time, they want the experience to feel distinct from everyday dining: 67% say a holiday meal should be “special,” with festive décor, seasonal menus, or set-price offers that elevate the occasion.

Spending follows suit. Families are willing to stretch their budgets for festive experiences, with 27% prepared to pay 25–49% more than usual, and many others are comfortable paying 10–24% more.

For hotels, this means promoting packages that cover school breaks, multigenerational stays, and seasonal events. For restaurants, the opportunity lies in offering inclusive festive menus and large-table bookings that strike a balance between generosity and ease of use. Across both, the goal is to market not just meals or rooms, but shared family experiences that feel worth celebrating. You could be starting their new family tradition.

Friends

Travel with friends is a defining characteristic of the festive season. Younger guests in particular are prioritising shared experiences, whether that’s a Friendsgiving dinner, a city break, or a New Year’s trip, and shaping their plans around social connection as much as destination or cost.

28% of Gen Z and Millennial travellers say they plan to travel with friends in the 2025 holiday season

In the U.S., Thanksgiving remains one of the biggest travel moments, with nearly 80 million people travelling 50 miles or more in 2024, and younger adults fuelling Friendsgiving celebrations that supplement or replace family gatherings.

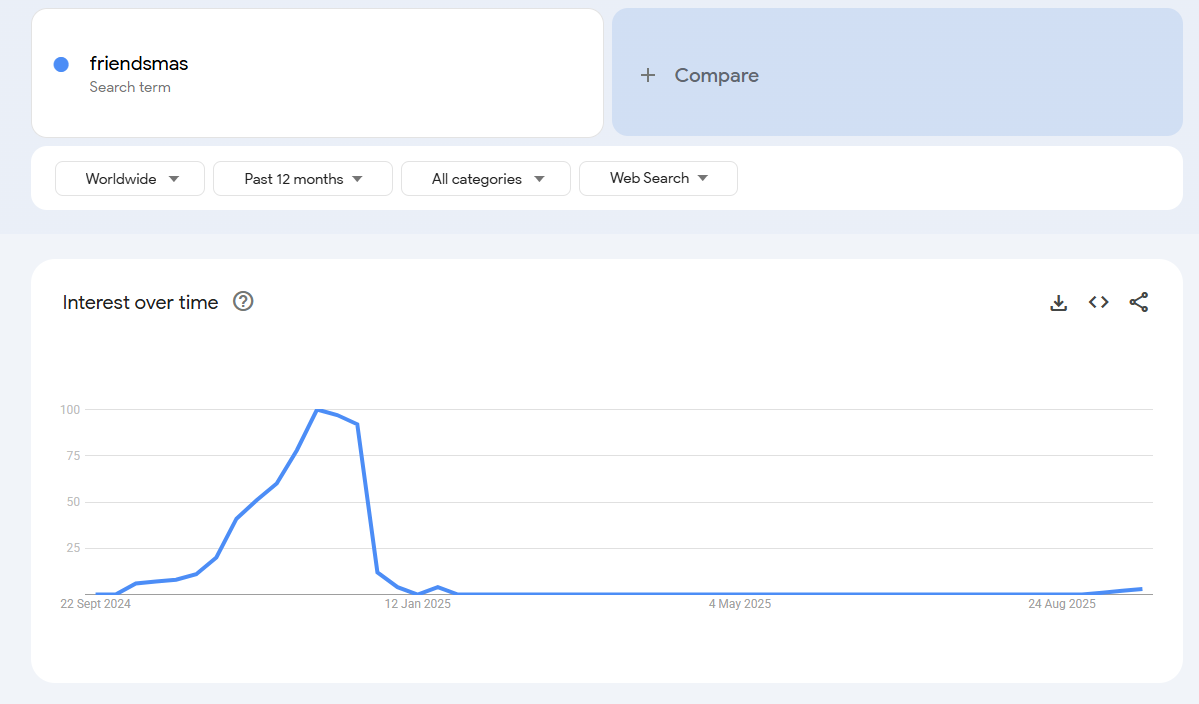

Searches for “Friendsmas,” “bottomless brunch,” and “midweek dinners” are on the rise, fueled by hybrid work that shifts get-togethers into weekdays as well as weekends.

Most holiday dining parties consist of 3-10 people, with 37% booking tables of 6–10 and 39% booking tables of 3–5. Larger groups of 12 or more form around New Year’s Eve or destination weekends, but the bulk of bookings sit in the mid-range. Cost-sharing makes this behaviour viable.

According to American Express, 92% of Gen Y and Z say food is a top priority when choosing destinations, and nearly 8% of younger travellers explicitly prioritise nightlife. Dining preferences lean toward celebratory formats — such as tasting menus, shareable platters, and cocktail packages — with the setting itself mattering as much as the food. Atmosphere, convenience, and menu flexibility all rank high, especially as mixed dietary needs are common within friend groups.

Planning habits are mixed. Smaller dinners or trips often come together spontaneously, but larger parties require coordination months in advance. Data from travel providers shows the best window to book Christmas flights is October through mid-November, and many groups follow this timeline. New Year’s Eve plans are typically confirmed later, with a surge of restaurant and bar bookings in early to mid-December as decisions finalise.

Spending is shaped by social pressure as much as the budget. Surveys show 37% of travellers admit to going beyond their budget to join group trips or events. While individuals may be cautious, in a group setting, they are more likely to commit to premium add-ons such as cocktail packages or seasonal menus.

Work and Corporate Groups

Corporate groups have begun to secure their end-of-year events and early 2026 incentive trips, with search demand ticking upwards for “Christmas party venues,” “private dining for business,” and “team off-sites.” Venues are expected to deliver a balance of celebration and professionalism, offering private spaces that can handle both festive atmosphere and networking.

In 2024, 59% of firms hosted holiday parties at outside venues such as restaurants, hotel ballrooms, and event spaces, up from 55% in 2023. Average attendance is also increasing, with surveys indicating that 81% of employees plan to attend seasonal events, up from 69% in 2024.

Group sizes vary widely. A small business may book a dinner for 10 employees, while large firms stage galas for hundreds. Most bookings, however, cluster around mid-sized events. Popular dates and venues are secured well in advance, often by mid-September. Hybrid work schedules are also shifting timing. Friday remains the most common day for parties (35%), but Thursday and even Wednesday evenings are now frequently used to boost attendance and manage costs more effectively.

When it comes to format, the majority of corporate groups opt for premium food and drinks over novel experiences. Corporate Challenge found that 35% of employees attended a traditional party, 27% attended a holiday lunch, 20% participated in a cocktail event, and 18% attended a formal sit-down dinner. Despite talk of immersive experiences, the overwhelming preference for corporate events remains dinners, buffets, or open-bar receptions that blend familiarity with festive atmosphere.

Employers see these gatherings as more than a formality. 85% believe holiday parties improve morale and strengthen team bonding. This explains why, even with tighter budgets or remote workforces, companies continue to invest in Q4 events. A small but notable minority also extend beyond the party itself, choosing destination off-sites or incentive trips in November or December that combine strategy retreats with leisure. This trend channels spending directly into hotels and resorts during the shoulder season.

📘 November Tactical Playbook

Group bookings follow their own rules. Decisions are collective, organisers carry more weight, and confidence matters as much as price. This playbook outlines the tactics that move groups from discussion to decision, helping your venue cut through the friction and secure more festive revenue.

🔒 VIP Lounge Access

Unlock the full playbook with detailed booking windows, campaign templates, and insider tactics you won’t find in the free edition.