💘 Your Valentine’s 2026 Playbook: Campaign Timing, Buyer Segments, and Strategy in Action

Discover how to time, target, and personalise your Valentine’s 2026 campaign with precision. Insights, strategy, and a ready-to-use playbook inside.

How early should a hotel or restaurant start promoting its Valentine’s Day offers? Which social media strategies are most effective for Valentine’s Day in hospitality? And when should you send “last chance” booking emails?

🌞 Hello and Welcome To Hospitality Marketing Insight, I’m your host, Dawn Gribble, and this week we’re exploring how you can capitalise on the latest trends and tactics for a successful Valentine’s Day in 2026

Valentine’s Day is hospitality’s most reliable, yet most competitive event. Each year, guests plan earlier, spend more, and expect greater value. In 2025, 59% of global Valentine’s Day consumers chose restaurant, hotel, and spa experiences over gifts. Tiered offers excelled, with guests trading up for exclusivity, convenience, and perceived quality.

This edition of Hospitality Marketing Insight distils the latest data and behavioural shifts into practical actions you can apply right now, from who’s buying to when to launch, and how to shape offers that sell out rather than discount down.

📄 On the Menu this week

💘 The Business of Valentine’s

🎯 Segmenting the Valentine’s Audience

🗺️ Valentine’s Guest Segmentation Framework

🚀 The Valentine’s 2026 Campaign Calendar

Let’s Check In ☕

💘 The Business of Valentine’s

Valentine’s remains one of hospitality’s most dependable trading opportunities, generating billions in discretionary spend across dining, travel, and wellness. In 2025, spending exceeded $27.5 billion in the US and £1.4 billion in the UK, representing a 7.1% year-over-year increase.

Experience-led categories such as restaurants, hotels, spas, and short breaks outperformed traditional retail. At the same time, premium hotel packages with champagne pairings, late checkouts, and other extras outperformed price-led deals by 15 to 20%. Spa packages and experiential dining were among the fastest-selling products worldwide, showing that demand is moving decisively toward personalised, high-touch experiences.

Consumer behaviour now diverges sharply between premium and value segments. High-spending guests seek exclusivity, such as tasting menus, wine flights, spa retreats, and surprise weekends, while value-driven consumers increasingly opt for supermarket dine-in boxes, takeaway kits, or curated at-home celebrations.

This year’s 7.1% increase in total spend was driven by shoppers with stronger financial means, who traded up across both in-store and online channels. Further economic recovery through 2025 is likely to sustain engagement in 2026, widening the target pool beyond couples to include self-gifters and experience seekers.

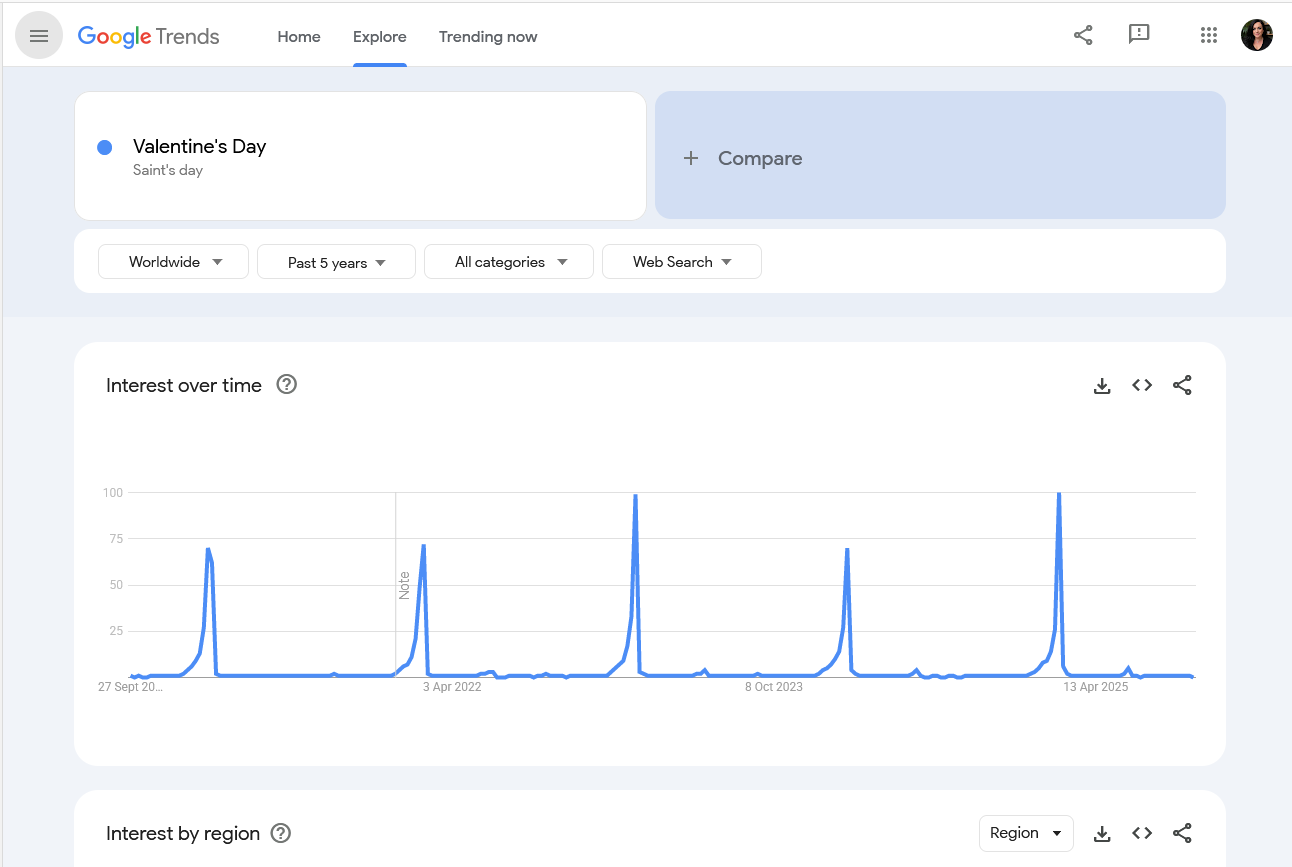

Valentine’s follows a predictable yet compressed booking curve that rewards precision timing. Search and research activity begins in late January as guests start comparing “romantic getaways” and “restaurants near me.” This early awareness window favours teaser content and PR visibility.

The decisive conversion period occurs between 7 and 13 February, when booking intent peaks across both hotels and restaurants. This is when most reservations are secured, and paid media delivers the strongest return on investment. The final 48 hours remain a lucrative scramble, driven by spontaneous diners and last-minute gifters, with Google Maps searches for restaurants peaking on the 14th itself.

Beyond the main event, spillover celebrations offer an underused opportunity: extended-stay packages, post-Valentine spa breaks, and gift-voucher redemptions that keep revenue flowing after the rush.

Despite the strong commercial outlook, the hospitality industry faces an unexpected rival in the Valentine’s Day race: supermarkets. Retailers such as Marks & Spencer have redefined “romance at home,” positioning £25 dine-in kits as indulgent yet effortless alternatives to dining out. The 2025 M&S Valentine’s menu, featuring dishes like sirloin steak with peppercorn butter, lobster thermidor, and heart-shaped desserts, sold out within days

This isn’t bargain hunting; it’s M&S bargain hunting (sorry, couldn’t resist). By offering restaurant-style quality without the need for a reservation, these curated boxes reset consumer value anchors and absorb spending that would have otherwise gone to casual dining. Yet this shift also opens a new lane for hospitality: creating premium at-home Valentine’s experiences such as chef-prepared meal kits, patisserie boxes, cocktail pairings, or “dine-in from our kitchen” packages that extend brand reach beyond the venue.

🎯 Segmenting the Valentine’s Audience

Around 6 in 10 consumers celebrated Valentine’s Day in 2025, but their reasons for doing so vary widely. Some participate out of affection or habit, while others seek recognition, shareability, or the social performance that now accompanies romance.

TikTok and Instagram have transformed Valentine’s Day into a public performance, where the quality of a celebration is often judged by its online appearance. This means that the emotional and financial strain surrounding the event is significant: 52% of shoppers and 67% of those aged 16 to 34 admit that last-minute buying leads to overspending, often amplified by social media comparison. Campaigns that recognise this pressure, or use humour and inclusivity to defuse it, consistently outperform those that rely on traditional romantic tropes. These dynamics aren’t universal; how people celebrate — or avoid — Valentine’s varies by region, reflecting local culture and spending confidence.

In Europe, the classic model of candlelit dining remains strong; however, there is a clear shift among Northern Europeans and UK consumers towards more relaxed alternatives, such as theatre, sports, or “normal-day” dinners.

Across Asia, Western-style Valentine’s celebrations continue to grow among younger urban audiences, blending with local traditions such as Japan’s “White Day” gift exchange. North America remains the highest-spending market, though many consumers express fatigue with commercial excess, preferring smaller gestures or home-cooked meals. Canadians exhibit similar pragmatism, seeking value even while celebrating.

Non-traditional celebrators are shaping new demand, from self-gifters to Galentine’s groups and wellness seekers, who are reframing the day as an opportunity for self-appreciation. Pets, friends, and family also feature strongly, with 30% of consumers buying for non-romantic recipients.

Globally, solo travel bookings doubled and group getaways rose 25% during the Valentine’s period (Airbnb, 2025), reinforcing that love, friendship, and self-care now coexist within the same market space.

At the same time, a growing audience of ambivalents is either fatigued, excluded, or simply priced out, opting for anti-Valentine’s experiences or skipping the event entirely.

So, who are your Valentine’s Day customer segments, how should you market to them, and what dates should be in your campaign diary? All will be revealed in the VIP Lounge

Let’s get to work 👇