📌 Flavours & Trends Driving Food and Drink in 2026

A strategic breakdown of the patterns emerging in food and drink, supporting hospitality marketers who want to move faster and deliver better outcomes.

What forces are reshaping consumer views on health and flavour in 2026? Which signals show the strongest commercial potential? How should brands respond?

🌞 Hello and Welcome To Hospitality Marketing Insight

I’m your host, Dawn Gribble, and this week we’re looking at the forces reshaping food and drink in 2026, and what they mean for hospitality marketing.

Functional benefits are now expected as standard.

Flavour is doing more work, influencing both emotional response and sensory experience.

Social media continues to accelerate these trends by turning emerging flavours and formats into mainstream expectations.

We will explore the emerging signals with the strongest commercial potential and consider how hospitality businesses can adapt their food and drink brand marketing as well-being, convenience, and emotion increasingly converge in consumer behaviour.

📄 On the Menu

Social Media Food Trends 2025 Review

Maxxing Out on Fibre & Protein

2026 Beverage Trends

Quick Wins

Let’s Check In ☕

👉 The full breakdown is best read online. Continue reading here.

Social Media Food Trends 2025 Review

Social media has become one of the most potent forces shaping food and drink behaviour, with 74% of consumers having bought a product after seeing it online and more than half sharing content after purchase. This interconnected social loop has created an environment where food trends can move from niche creator content to mass retail within weeks, not months.

Throughout 2025, the relationship among consumers, creators, and platforms has intensified. 90% of shoppers say friends and family influence their decisions, while 89% of shoppers who follow creators say they are influential at every stage of the purchase journey, from discovery to trial. 67% of consumers trust creator recommendations, and 74% say they are likely to try a new launch promoted by a creator.

The type of content that drives sales is consistent: product reviews, shopping ideas (48%), recipe suggestions (46%), tutorials (43%) and shopping hauls (36%) all rank highly. These formats allow consumers to visualise flavour, texture and experience before purchase, shortening the journey from curiosity to conversion.

TikTok dominates flavour discovery, while Snapchat leads in impulse and visual trial moments. Viral formats such as Matcha Einspanner, Pickle Cotton Candy, and Dubai Chocolate Bar each recorded 1,000%+ TikTok growth.

TikTok’s 2025 Viral Flavours

Dubai Chocolate Bar (+1,000% YoY)

Matcha Einspanner (+1.000 % YoY)

Pickle Cotton Candy (+1,000% YoY)

Honey Chipotle Sauce (+1,000% YoY)

Pistachio Cream (+644.8% YoY)

Ceremonial-grade Matcha (+614.1% YoY)

These reflect three clear territories: novelty, premiumisation, and sensory play.

Daily Snapchatters are 1.6x more likely to buy drinks on impulse, 1.6x more likely to try new brands, and 1.5x more likely to trust creator content than non-Snapchatters. Importantly, 94% of this group state that any social platform plays a role in their purchase decisions. AR is becoming a competitive advantage in itself, with 71% of shoppers expressing interest in AR experiences from food and drink brands, and daily Snapchatters 2.8x more likely to buy from brands offering AR-led content.

Meanwhile, broader social topics influenced by wellness culture shaped the year. 61% of Millennials and 70% of Gen Z now get nutrition advice from social media, pushing trends linked to gut health, mood support and “food therapy” into everyday meal choices.

For hospitality businesses, the message is clear. Social media determines what guests expect before they arrive, and the strongest opportunities lie in flavour-led specials, limited editions and creator-aligned collaborations that tap into these cultural moments. With 65% of consumers open to emerging food and drink trends, operators who translate viral interest into accessible menu formats will remain culturally relevant and commercially competitive throughout 2026.

🥛 Maxxing Out on Protein & Fibre

Consumers are increasing their protein and fibre intake at scale, and the commercial impact for hospitality is significant. Nearly 60% of global food and beverage consumers say they are actively increasing their protein intake, and many are now setting specific intake goals of 30 to 40 grams per meal. This pattern is driving demand for nutrition-rich menus and ready-to-go formats that combine nutritional value with a strong flavour experience.

The Maxxing Out trend focuses on nutrient density, ingredient diversity and functionality, with consumers looking for products that support everyday wellbeing. The market for protein-fortified products is projected to reach 27.4 billion US dollars by 2034, expanding at a CAGR of 8.5%.

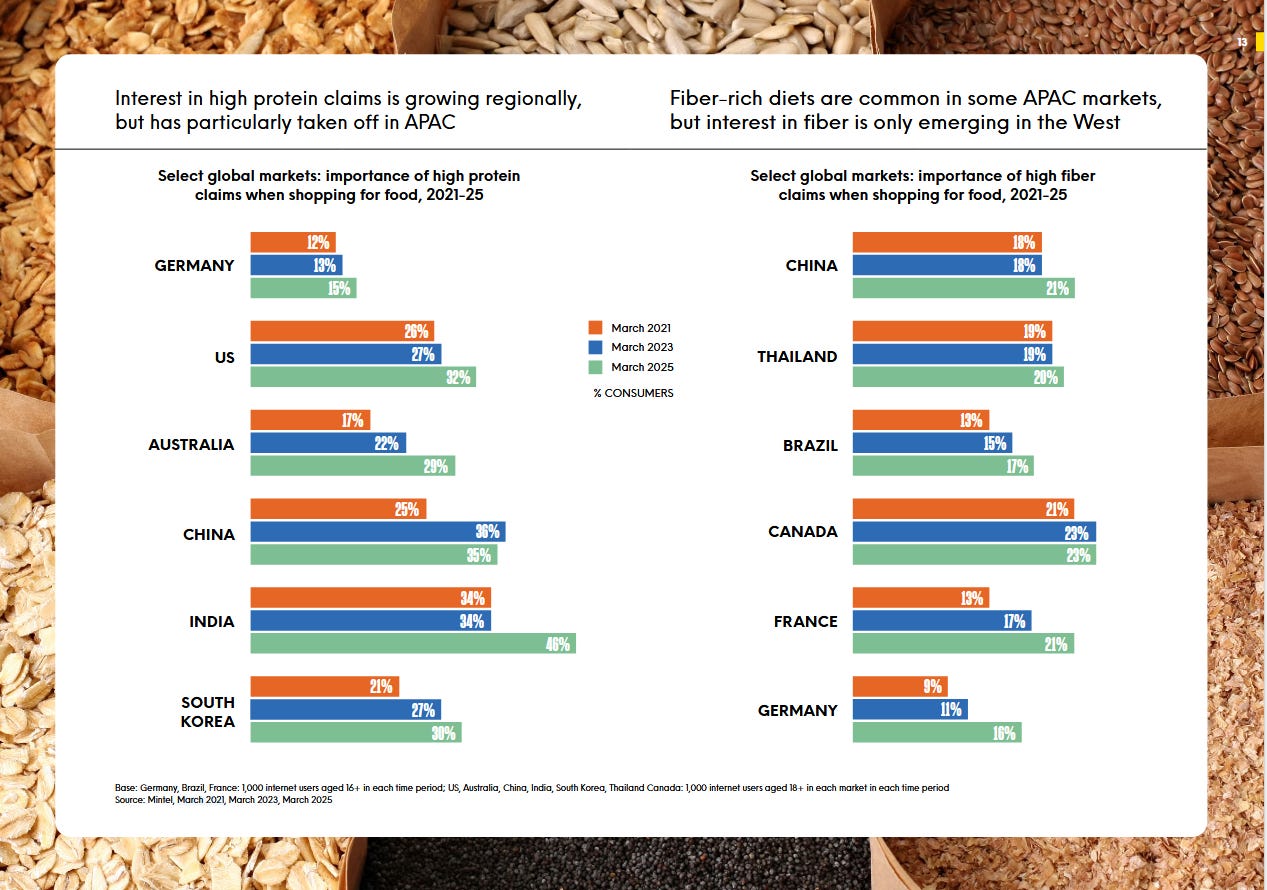

Protein continues to lead global consumer interest because it supports satiety, muscle maintenance and holistic wellness, making it relevant across age groups and dayparts. Its evolution from a performance-focused nutrient to a mainstream expectation is reshaping category strategies. Mintel notes that high-protein claims are already embedded in many European and American markets, while demand is accelerating rapidly in Asia Pacific, widening the commercial window.

The landscape is also diversifying. Alongside dominant animal-based proteins, consumers are seeking authentic plant proteins such as pea, chickpea, mung bean, fava bean, soy, and almond, valued for their nutritional and sustainability profiles. Interest in alternative protein sources such as fungal proteins, microalgae, and hemp seeds is rising as consumers seek nutrient-dense options that offer more than traditional formats.

A distinct segment shaping innovation is GLP-1 users. GLP-1 medications help regulate appetite; patients are advised to focus on their protein intake. These consumers experience reduced hunger but still seek texture, reward and emotional satisfaction. This creates demand for protein-rich snacks that deliver crunch, chew or creaminess while meeting heightened nutritional expectations.

Fibre is following a more nuanced trajectory. In Western markets, interest in high-fibre claims is only beginning to gain traction, driven primarily by gut health and the growing belief that digestive wellness underpins overall wellbeing. In contrast, Asia Pacific consumers already view fibre as a regular part of daily eating patterns, giving brands in these regions a head start.

Looking ahead, Mintel identifies fibre’s repositioning as nutritional armour against the potential long-term health effects of microplastics. This presents a clear opportunity for hospitality businesses to create fibre-forward options.

Fibre presents emerging commercial opportunities, particularly when associated with gut health, natural ingredients, and high-quality textures. Businesses that respond early will be positioned to meet rising expectations across both functional and flavour-led categories.

The chart below shows how interest in protein and fibre differs across global markets.

🙏 This is the complimentary edition of Hospitality Marketing Insight, brought to you by Dawn Gribble, and made possible through the kind support of our VIP subscribers and sponsors.

This week, we are looking at the forces reshaping how consumers choose food, drink and value, and what this means for marketing strategy and hospitality brands.

🗝 Upgrade to a VIP subscription to unlock 90+ exclusive playbooks and frameworks, in-depth campaign plans, marketing reports, and expert trend analysis created for hotels, restaurants, and hospitality brands.

📅 New VIP strategy editions are published every Thursday.

🥤 2026 Beverage Trends

The global drinks category has entered one of its most competitive periods, with consumers demonstrating both value sensitivity and a willingness to try new flavours. 65% of drink buyers say they are open to emerging beverage trends.

72% of global drink buyers have used cost-saving strategies in the last three months, yet 61% still make purchase decisions based on promotions, demonstrating how critical flavour novelty, perceived value and timing have become. Meanwhile, the functional drinks market continues to expand rapidly. Valued at $364 billion, it is growing at a 10%+ CAGR and is projected to exceed $793 billion by 2032, driven by interest in hydration, energy, relaxation and gut health.

Flavour innovation has therefore become a core commercial lever, because it directly stimulates curiosity, trial and repeat purchase in a category where many products compete on similar claims. Understanding flavour trajectories is essential for shaping a 12–36 month innovation pipeline, particularly as consumers seek drinks that offer sensory excitement, functional reassurance and permissible indulgence.

Key Themes Reshaping 2026

🍍Fruit-Led Innovation

The Focus on Fruit continues to strengthen through premiumisation and discovery. Consumers are moving beyond familiar citrus into exotic and tropical profiles that signal quality, authenticity and flavour exploration. Social and conversational data show substantial rises in interest for summer berry (+77%), dragon fruit (+23%) and early-stage flavours such as mangosteen (+77%). Market activity aligns with these signals. Pineapple-led beverages generated 28,677 conversations last year and are positioned in the 0–12 month innovation horizon, with dragon fruit in the 12–24 month window and mangosteen in the 24+ month horizon.

🍰 Dessert-Inspired Drinks

The Dessert trend is accelerating, fuelled by the sober-curious movement, interest in alcohol alternatives, and a desire for indulgence without excess. Carbonated Soft Drinks (CSDs) have surged in dessert-led formats, with USA launches up 177% in the last five years. New dessert-led flavours entering the market in the past 12 months include, spanning bakery cues such as brownie, cinnamon bun, doughnut and shortcake, alongside confectionery and dairy profiles such as yoghurt, salted caramel and sugar icing.

Consumer conversation data reinforces the trend. Marshmallow is up 19%, peaches and cream up 33%, and cream soda up 32%. The rise of DIY “dirty soda” culture on TikTok, combined with the nostalgic flavour appeal of the traditional ‘Coke Float’, is expanding the innovation lane.

For hospitality businesses, flavour-led innovation provides a clear commercial advantage. Fruit and dessert trends enable operators to introduce low-risk, high-impact limited editions, expand non-alcoholic menus and tap into social-media-led discovery moments.

Operators who translate these trajectories into accessible formats will be well-placed to capture guest attention and incremental revenue throughout 2026.

⭐ Top 5 High-Impact Quick Wins for Hospitality Marketers

⭐ Launch Social-First, Trend-Led Flavour Campaigns

Use viral flavours like matcha, pistachio cream, pineapple, honey chipotle and marshmallow as content drivers across TikTok and Reels, creating short-form tasting clips, behind-the-scenes videos and first-sip reactions that build relevance and reach before guests arrive on site. This helps you reach new audiences quickly and increases the chance of guests choosing you when they are ready to buy.

⭐ Use Micro-Creators as a Conversion Channel

Work with micro-creators to front new drink and menu moments with straightforward, creator-led content, including taste tests, order-with-me videos, and visual walk-throughs that encourage trial and strengthen intent. This type of content builds trust and increases confidence in trying your food and drink.

⭐ Serve Impulse Behaviour on Snapchat

Create Snap-only time-limited offers and flavour drops, supported by vertical video and creator reactions, to capitalise on a high-intent audience who respond strongly to immediacy and novelty. You encourage quick decisions and prompt fast visits from people acting in the moment.

⭐ Build Mood-Led Campaigns Around Emotional Cues

Position drinks and snacks using emotional language such as refreshing, calming, uplifting and comforting, supported by visual cues and sensory-led creative that aligns with wellness-driven browsing behaviour. This makes your offer feel more relevant to how guests want to feel, which strengthens engagement and preference.

⭐ Turn Seasonal or One-Off Items Into Mini Campaigns

Promote seasonal or one-off items through short marketing cycles that include previews, countdowns, creator content and closing highlights to build attention and repeat engagement. You create regular spikes in interest and encourage guests to return more often to see what is new.

📅 Coming Up in Thursday’s VIP Edition

Coming up this week in our VIP edition, everything you need to build a Multisensory Marketing Strategy - I’ll show you how to use sound, colour, texture and flavour cues to increase dwell time, strengthen memory recall and lift conversion across your food and drink campaigns.

That’s all for today. Thank you for reading and for being part of this community of sharp, curious thinkers. If you found this helpful edition, feel free to share it with someone who would benefit. Every share helps the research reach the people shaping what comes next.

All my work is free to read. If you’ve been enjoying it and want to support the time and research that goes into each issue, you can buy me a coffee using the link below. Your support genuinely helps me keep creating.

All the best

Dawn Gribble MIH MCIM

Hospitality Marketing Insight

Here’s to Your Success 🥂

Ready to go deeper? Expense a Subscription for just £10 a month or £100 for the year. The VIP Edition unlocks advanced strategy, exclusive data and practical playbooks.

📚 Sources & Resources

Ashby, E., From grocerants to fashion cafes – The Gen Z food trends reshaping design, Design Week (2025)

Bagels crowned global favourite as Brits drive Deliveroo’s top food trends for 2025, Larder Magazine (2025)

Carroll, N., How ‘less healthy food’ ad restrictions may change the way brands are built, Marketing Week (2025)

Casual Cuisines and Local Flavors Dominate 2026 Asian Pacific Food Trends, Food Drink Life (2025)

CNS MEDIA, Innova Market Insights announces F&B trends for 2026: Gut health, protein & stress relief, Food Ingredients First (2025)

Datassential releases 2026 Food and Beverage Trends report, Blue Book (2025)

Eastlake, D., Top 5 functional F&B ingredients trends for 2026, FoodNavigator.com (2025)

Europe Halal Food Market Trends & Summary 2025–2033, History (2025)

Food trends gone wrong: 6 millennial habits that can damage your health, RBC-Ukraine (2025)

Frozen Food Market Trends & Summary, Feast (2025)

Global Food & Drink Predictions: 2026 & Beyond, Mintel (2025)

Halal Food Market: Size, Trends & Forecast 2025–2033, Journal (2025)

How TikTok food trends are inspiring brand innovation and limited-edition flavors, oodNavigator-USA.com (2025)

Johnson, G., Datassential releases 2026 Food and Beverage Trends report, Blue Book (2025)

Kelly, K., Casual Cuisines and Local Flavors Dominate 2026 Asian Pacific Food Trends, Food Drink Life (2025)

Martinez, T., Top Instagram Food Trends and Statistics for 2025, On the Line (2025)

Mintel, Drinks Flavors for 2026: What’s next in CSDs?, Mintel (2025)

Natural Food Colors Market Trends & Summary, Feast (2025)

Neo, P., 5 major food industry trends spotted at Fi Asia 2025, FoodNavigator-Asia.com (2025)

Rankin, J., EU court rules non-alcoholic drinks cannot be called gin, The Guardian (2025)

The GLP-1 Economy: How Smaller Appetites Are Changing Restaurant Strategy, Modern Restaurant Management (2025)

The Rise of Fiber: How Brands Can Win With the Next Nutrient, Mintel (2025)

Top 100 Food Trends in September, TrendHunter.com (2025)

Troyli, J., How TikTok food trends are inspiring brand innovation and limited-edition flavors, FoodNavigator-USA.com (2025)

A Taste of Success: How Brands Can Navigate Evolving Food and Drink Trends, Snapchat for Business (2025)

Whole Foods Says These Will Be The Biggest Food Trends Of 2026, Southern Living (2025)